Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

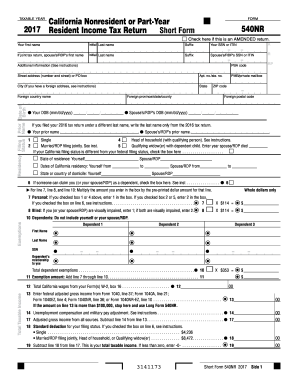

What is the purpose of california form 540nr tax?

California Form 540NR is a short version of the Form 540 used by California residents to file their state income taxes. It is specifically designed for nonresidents, part-year residents, and residents who are required to file in multiple states. The form is used to report income earned while living in or visiting California, as well as apportionment of income earned in multiple states. It also allows for the deducting of certain expenses, such as taxes and charitable contributions, from taxable income.

What information must be reported on california form 540nr tax?

California Form 540NR Tax is used by nonresidents and part-year residents of California to report their taxable income, deductions, and credits. Information that must be reported on California Form 540NR Tax includes:

• Taxable income and deductions

• Nonrefundable credits

• Refundable credits

• Taxable gain or loss from the sale of property

• State taxes paid to other states or countries

• Amount of any estimated tax payments

• Any additional taxes or interest due

• Any overpayment refunded to you

• Any other information necessary to compute your California income tax.

When is the deadline to file california form 540nr tax in 2023?

The deadline to file California Form 540NR Tax in 2023 is April 15, 2023.

What is the penalty for the late filing of california form 540nr tax?

The penalty for late filing of California Form 540NR tax is 10% of the unpaid tax amount, up to a maximum of $500. In addition, there may be an additional penalty of 5% for each month (or part of a month) that the tax return is late, up to a maximum of 25%.

What is california form 540nr tax?

California Form 540NR is the state tax return form for nonresidents and part-year residents who need to file their individual income tax in California. It is specifically designed for people who do not qualify as full-year residents of California, either because they did not live there for the entire tax year or because they are not considered residents for tax purposes. Form 540NR allows individuals to report their income earned in California and calculate the appropriate state tax liability based on their nonresident or part-year status.

Who is required to file california form 540nr tax?

California Form 540NR is used by individuals who are nonresidents or part-year residents of California and have income from California sources. Generally, you would need to file Form 540NR if you meet any of the following criteria:

1. You were a nonresident of California and had income from California sources.

2. You were a part-year resident of California and had income from California sources during the part of the year you were a resident.

3. You were a nonresident or part-year resident and received income from California sources that was subject to withholding.

It is recommended to consult the California Franchise Tax Board or a tax professional for confirmation and guidance specific to your situation.

How to fill out california form 540nr tax?

To fill out California Form 540NR for nonresidents or part-year residents, follow these steps:

1. Gather your tax documents: Gather all the necessary documents you need to complete your tax return, such as W-2 forms, 1099s, and any other income statements.

2. Determine your residency status: Determine whether you are a nonresident or part-year resident for California tax purposes. Nonresidents do not have to report income earned outside of California, while part-year residents need to allocate their income based on the period they were a California resident.

3. Identify your filing status: Choose your filing status based on your marital status as of the end of the tax year.

4. Complete the personal information section: Provide your personal information, including your name, address, Social Security number, and dates of residency in California.

5. Calculate your income: Calculate your income earned during the tax year, including wages, self-employment income, rental income, and any other taxable income.

6. Deduct applicable expenses: Subtract any applicable deductions, such as student loan interest, IRA contributions, and other eligible expenses.

7. Calculate your California taxable income: Subtract any allowed deductions from your total income to determine your California taxable income.

8. Compute your tax liability: Use the California tax rate schedule provided with the form to calculate your tax liability based on your taxable income.

9. Determine your credits and payments: Determine any credits or payments you may be eligible for, such as withholding tax, estimated tax payments, or California tax credits.

10. Complete the tax computation section: Fill out the tax computation section of the form by entering the relevant figures for tax liability, credits, and payments.

11. Finalize and sign: Double-check all the entries on the form and sign and date it. If you're mailing in your return, attach all supporting documentation, and mail the form to the appropriate address. If you're filing electronically, follow the instructions to submit your return online.

Remember to consult the California Form 540NR instructions and seek professional assistance if needed to ensure accuracy and completeness.

How do I execute ca short tax return online?

pdfFiller makes it easy to finish and sign california form part tax online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit california 540nr nonresident form online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your california 540 nr to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out the 540nr part year resident form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign short form 540 nr and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.